A Year in Review

Public opinion research allows the government to obtain information on Canadians’ opinions and attitudes in order to respond to their needs. The government uses this information for three broad applications: identify areas to improve the way the government serves Canadians, take Canadians’ needs into account in all aspects of governance, and inform Canadians about its various policies, programs and services.

In 2013-2014, a total of 81 contracted public opinion research projects worth $4.9 million were coordinated through the Public Opinion Research Directorate. Of these projects, 24 were conducted to strengthen policies and to develop communication strategies and products that take into account Canadians’ needs; 25 projects were conducted to ensure easy access to information and services, help understand Canadians’ views and measure their satisfaction in order to better serve Canadians; and the remaining 32 projects supported the Government of Canada in its efforts to effectively inform Canadians of the various government programs, policies and services.

Table Summary

The table entitled “Areas of Application for Contracted Public Opinion Research” has three columns and five rows. The first column contains the names of the three areas of applications. The two other columns headers are: “Contract Value” and “Number of Projects”. The last row of the table provides the totals for each area of applications.

| Contract ValueFootnote 5 | Number of ProjectsFootnote 5 | |

|---|---|---|

| Taking into Account Canadians' Needs | $1,471,349 | 24 |

| Serving Canadians Better | $1,899,980 | 25 |

| Informing Canadians | $1,561,020 | 32 |

| Total: | $4,932,349 | 81 |

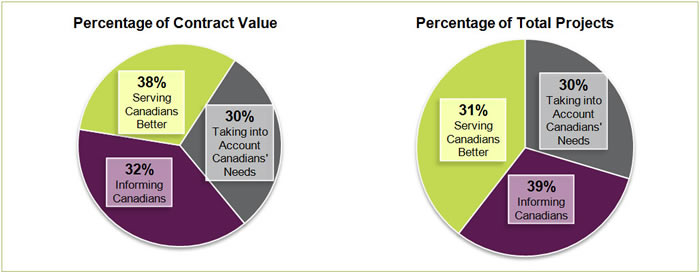

Figure 1: Areas of Application for Contracted Public Opinion ResearchNote 6

Image Description

Figure 1 is two pie charts, divided in three sections, one for each of the three areas of application of public opinion research. One pie chart provides the percentages of the total projects and the other pie chart provides the percentages of the contract value. The following information is presented in the sections of the pie chart:

- Taking into Account Canadians' Needs: accounted for 30 percent of the contract value and of the 30 percent of the total POR projects in the Government of Canada.

- Serving Canadians Better: accounted for 38 percent of the contract value and of the 31 percent of the total POR projects in the Government of Canada.

- Informing Canadians: accounted for 32 percent of the contract value and of the 39 percent of the total POR projects in the Government of Canada.

Taking into Account Canadians' Needs

With the results from public opinion research, the Government of Canada can better identify the needs of Canadians and work at improving existing policies and programs and to put forward new initiatives. Public opinion research helps the government to have a better understanding of the public’s attitudes and perspectives on a given subject. It also assists in the development and delivery of government programs and information products and helps identify the best approaches and vehicles to use in order to reach out to Canadians. This is achieved with:

- Policy development and review: The government collects information on attitudes and opinions to help tailor public policies that reflect the needs and wants of Canadians, or specific stakeholder groups affected by those policies.

- Communications plan development: This type of research measures awareness, attitudes and behavioural intentions to help the government better communicate with Canadians. It helps identify the best approaches to reach out to the public and helps develop and refine messages, for example, in guides or brochures.

- Communication product testing: This type of research includes the evaluation of concepts, messages, content and creative design.

In 2013-2014, studies conducted to take into account Canadians’ needs accounted for 30 percent of the total contract value of public opinion research. (See Figure 1.)

Serving Canadians Better

Public opinion research is used to understand how people view government policies, programs and services. It helps the government assess the level of engagement and satisfaction of Canadians with respect to the services offered and the initiatives put in by their government. It also allows the government to find ways to improve these services. This can be done by means of:

- Market research: This type of research involves collecting information on attitudes, opinions and product attributes that will help in the design and delivery of programs and services.

- Quality of service and client satisfaction: This type of research helps the government evaluate experiences and identify interests and priorities in order to be aware of areas requiring improvement. It provides the government with the means to understand the drivers of client satisfaction and identify areas where clients seek information. This type of study also includes research supporting a more productive work environment.

- Policy and program evaluation: This type of research helps evaluate the effectiveness of programs and services and the factors driving their usefulness to Canadians.

- Web site usability testing: This type of research involves the testing of new or revised Web pages to ensure that they are functional, comprehensive and useful. The content, format, features and ease of navigation are tested to ensure government Web sites meet the needs of the intended user.

Studies undertaken to better serve Canadians accounted for 38 percent of the total contract value of public opinion research for the 2013-2014 fiscal year. (See Figure 1.)

Informing Canadians

The government has a duty to explain its policies and decisions to Canadians and inform them of available programs and services. Public opinion research helps ensure that information about policies, programs and services is clear, concise and targeted to appropriate audiences through:

- Advertising pretesting: This type of research is used to test advertising materials and concepts associated with major campaigns. This helps to ensure that the materials and texts are clear and well understood before they are used in advertisements. Pretesting is mandatory for campaigns with a media buy of $400,000 or moreFootnote 7.

- Advertising post evaluation: This type of research is used to measure recall and recognition of major advertising campaigns, as well as attitude and behavioural changes resulting from these campaigns. Post evaluation of advertising is mandatory for campaigns with a media buy of $1 million or moreFootnote 8. The information from these studies is used to improve the planning and development of current and future advertising campaigns.

Studies to inform Canadians accounted for 32 percent of the total contract value of public opinion research for the 2013-2014 fiscal year. (See Figure 1.)

Research Approaches

Public opinion research relies on various data collection techniques to obtain information from a wide variety of audiences. The research approaches used to reach these audiences include qualitative methodologies, quantitative methodologies or a combination of both, referred to as a mixed-mode approach.

Qualitative research is widely used to gain insights into people’s behaviours and perceptions and explore their opinions on a particular topic. This approach is typically used when the research needed is exploratory, in-depth or about very complex issues. It relies on semi-structured or unstructured interviews where the moderator or interviewer works with a discussion guide that can be adapted according to the participants’ individual experiences and responses. The most commonly used qualitative techniques are focus group discussions, group interviews and personal interviews. Qualitative methodologies do not yield numeric data and the findings cannot be projected to the general population. During the 2013-2014 fiscal year, 30 projects undertaken used qualitative methodologies, accounting for 32% of the total contract value for public opinion research studies.

Quantitative research uses a more systematic approach to collect and analyze information obtained from a sample of the target population. This method includes structured techniques, such as surveys, with the aim of drawing conclusions for the total target population to provide results. A quantitative approach is typically used when statistics or numerical results are required. In 2013-2014, 35 of the projects undertaken used quantitative methodologies, representing 30% of the total contract value.

Qualitative and quantitative research methods can be combined over the course of a study to meet various research objectives. Studies based on both quantitative and qualitative methodologies accounted for the remaining 16 projects, or 38% percent of the total contract value of the projects undertaken during the 2013-2014 fiscal year.

Footnotes

- Footnote 5

-

The number of projects and contract values (rounded to the nearest dollar) represent contractual transactions issued between April 1, 2013 and March 31, 2014 (including amendments to increase, cancel or reduce the value of the contracts issued from previous fiscal years).

- Footnote 6

-

The figures have been rounded to the nearest percentage point.

- Footnote 7

-

See the section entitled “Procedures for Planning, Contracting and Evaluating Advertising” in the Communications Policy of the Government of Canada: Procedures, 2008.

- Footnote 8

-

See the section entitled “Procedures for Planning, Contracting and Evaluating Advertising” in the Communications Policy of the Government of Canada: Procedures, 2008.

- Date modified: