Life cycle cost analysis and replacement study for the Alexandra Bridge

In 2017, Public Services and Procurement Canada (PSPC) undertook a life cycle cost analysis and replacement study for the interprovincial Alexandra Bridge. The study was used as an internal document within PSPC to assist in the decision to rehabilitate the existing structure or to replace it with a new contemporary structure, a replacement “in kind” or a signature structure.

The executive summary summarizes the key points of the report. For the full report, please contact Real Property.

Executive summary

Note

The term “signature” throughout this report is used to indicate a structure that is more than merely functional, perhaps even iconic, and is respecting the unique and impressive current structure as well as the immediate geography and stature of the Parliament adjacent to it.

The existing steel superstructure of the Alexandra Bridge is demonstrating signs of ongoing and accelerated deterioration since the last 2009 to 2010 rehabilitation contract. The deteriorating steel condition combined with the need to replace the existing east and west side cantilever decks and additional costly capital expenditures required to maintain the structure in a safe operating condition has led PSPC to study alternative options to replace the bridge. The department has performed a life cycle cost analysis to compare the option of the rehabilitation of the existing bridge versus its replacement.

The Alexandra Bridge was initially designed as a multi-modal bridge, for use by steam railway, streetcars, horse-drawn wagons and pedestrians between the cities of Hull and Ottawa. It was constructed between 1898 and 1900 and was opened for traffic in the spring of 1901. The bridge has a long history of repairs and modifications, including change in modal use with the last major rehabilitation completed in 2009 to 2010 and additional work at the trestle spans in 2014. In 2016 to 2017, local replacement of deteriorated steel members was completed.

PSPC’s primary objective was to evaluate the existing condition and long-term costs of maintaining the existing bridge. For comparison purposes, it was desirable to develop alternatives for new structures and to obtain cost estimates of these alternatives to enable PSPC to take a position for internal consideration before proceeding to the next step.

A number of replacement alternative concepts were developed for a new contemporary and signature bridge as part of the life cycle cost analysis. This was completed because of PSPC’s concern regarding continuing escalating maintenance costs to the Crown for the care of the Alexandra Bridge. PSPC determined there was value in looking at alternative options. The alternatives were evaluated and screened considering several criteria using a weighted approach. This led to the selection of a contemporary alternative (slab-on-steel girder) and signature alternative (tied-arch structure), as well as a replacement-in-kind alternative (steel truss) being retained for concept development at a functional design level and for cost-estimating purposes. The retained alternatives are not meant for detail design and implementation at this stage but rather only to evaluate both the significance of the Alexandra Bridge within the nation’s capital and the surrounding urban fabric and the merits of replacing the structure and to place future capital decisions in the context of a range of potential costs to the Crown.

With input from key stakeholders and PSPC representatives, design criteria and functional plans were developed for the retained replacement in kind, and the contemporary and signature alternatives. Considerations included the context and fit with the surrounding urban fabric of the nation’s capital, the approaching roadways on the Ottawa and Gatineau sides, existing foundation and geotechnical conditions, local land ownership and usage, as well as marine traffic.

In the rehabilitation option, the existing structure will be maintained but it will be required to raise the bridge condition rating to a fair condition (rating of four as per the PSPC Bridge Inspection Manual) within five years. The most notable items of work to be addressed within five years include east and west side deck immediate repairs and replacement, steel repairs, bearing replacement and complete bridge recoating. In the medium to longer term (approximately 10 to 25 years), work required to maintain the structure to a fair condition includes pin/eye bar retrofits, steel repairs, recoating work, substructure masonry rehabilitation and pier erosion protection. There are risks and unknowns as the medium to longer term work is more difficult to scope and predict than the immediate work to be completed within the first five years.

Initial capital cost estimates were developed for each of the rehabilitation and replacement options utilizing detailed unit price estimates obtained from historical information from other similar projects and then compared with parametric costs (costs per unit area). It’s important to note that these are estimates, being used to compare the different options. These costs are not final and may increase over time but they will not change the ranking of the options. Cost estimates factored in the location and significance of the Alexandra Bridge as a landmark and important element in the downtown core of the nation’s capital. The estimates also included specific requirements to meet Confederation Boulevard’s streetscape amenities for pedestrians, bicycles and vehicular traffic standards. Cost estimates also included contingencies for costs, project management and engineering design, and risk. An additional provision or contingency was itemized for the signature bridge option, as per the following table.

| Alternative | Capital cost | Construction risk | Potential total cost |

|---|---|---|---|

| Maintain existing (for 25 years) | 244,300,000 | 97,700,000 | 342,000,000 |

| Replacement in kind | 221,000,000 | 66,300,000 | 287,300,000 |

| Contemporary replacement | 162,000,000 | 32,400,000 | 194,400,000 |

| Signature replacement | 292,000,000 | 116,800,000 | 408,800,000 |

| Possible cost of different signature bridge | N/A | N/A | 800,000,000 |

The high cost to maintain the current structure means that doing so is a more expensive option than replacing it with two of the three replacement scenarios.

PSPC may elect, via a design competition or other design procurement, means to choose an even more elaborate type of signature structure (given the importance of the setting and the significance of the Alexandra Bridge crossing) rather than the steel-tied arch, which has been assumed for the signature bridge replacement cost.

Life cycle cost models were developed to determine the cost of each alternative over the course of its lifetime, including anticipated future expenditures needed to maintain the bridge.

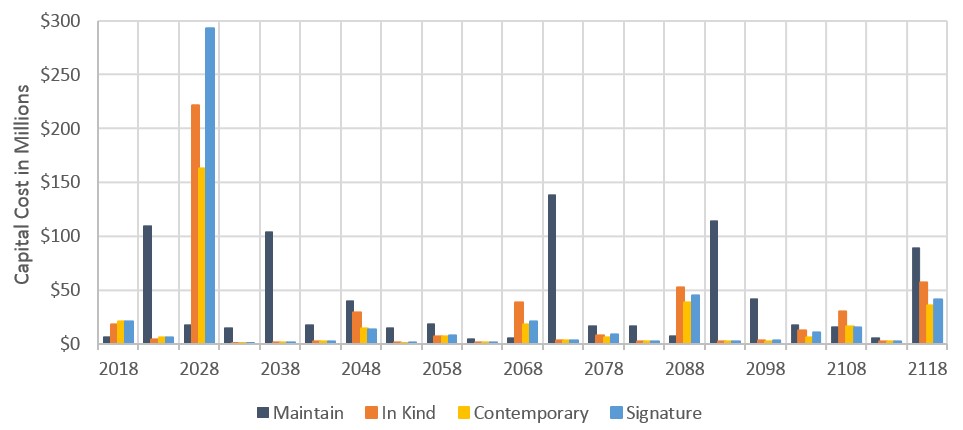

Total cost schedule for each of the generated life cycle cost models for the next 100 years

The figure illustrates the total cost schedule for each of the generated life cycle cost models for the next 100 years. This graphic shows that after initial high capital costs for the three replacement options, the required repairs are well spaced in time and at relatively lower costs when compared to maintaining the existing structure. Maintaining the existing structure will require numerous large spikes in costs compared with replacement options such as in kind or as a signature bridge type.

Table: Total cost schedule for each of the generated life cycle cost models for the next 100 years, capital cost (in millions of dollars)

| Year | Maintain | Replacement in kind | Contemporary | Signature |

|---|---|---|---|---|

| 2018 | 6,970,000.00 | 18,808,578.73 | 21,610,000.00 | 21,610,000.00 |

| 2023 | 109,736,000.00 | 4,834,625.39 | 6,636,000.00 | 6,636,000.00 |

| 2028 | 17,534,061.65 | 221,695,000.00 | 162,670,000.00 | 292,695,000.00 |

| 2033 | 14,926,515.81 | 700,000.00 | 700,000.00 | 700,000.00 |

| 2038 | 103,992,633.64 | 1,615,000.00 | 1,290,000.00 | 1,615,000.00 |

| 2043 | 17,852,633.64 | 2,542,150.00 | 2,563,100.00 | 2,740,150.00 |

| 2048 | 40,132,891.15 | 29,120,000.00 | 14,935,000.00 | 13,775,000.00 |

| 2053 | 15,050,885.69 | 1,725,800.00 | 770,450.00 | 1,435,400.00 |

| 2058 | 18,510,885.69 | 7,420,705.53 | 7,202,674.70 | 8,220,955.53 |

| 2063 | 4,588,880.23 | 2,077,955.53 | 2,010,924.70 | 2,077,955.53 |

| 2068 | 5,488,880.23 | 38,547,955.53 | 17,935,924.70 | 21,387,955.53 |

| 2073 | 138,385,137.74 | 3,350,105.53 | 3,354,024.70 | 3,548,105.53 |

| 2078 | 17,367,132.28 | 8,546,005.53 | 6,489,874.70 | 8,659,855.53 |

| 2083 | 17,187,132.28 | 2,721,451.43 | 2,654,420.61 | 2,721,451.43 |

| 2088 | 7,905,126.82 | 52,960,701.43 | 38,461,920.61 | 45,692,451.43 |

| 2093 | 114,765,126.82 | 2,721,451.43 | 2,654,420.61 | 2,721,451.43 |

| 2098 | 42,069,137.74 | 3,221,451.43 | 2,904,420.61 | 3,221,451.43 |

| 2103 | 17,867,132.28 | 12,832,651.43 | 6,411,470.61 | 11,197,501.43 |

| 2108 | 15,767,132.28 | 30,446,451.43 | 16,269,420.61 | 15,101,451.43 |

| 2113 | 6,045,126.82 | 2,721,451.43 | 2,654,420.61 | 2,721,451.43 |

| 2118 | 89,653,655.93 | 57,286,207.16 | 36,085,903.04 | 41,106,307.16 |

Summary of the present value of the alternatives for replacement at 10 years for different discount rates (in dollars)

A present value analysis was used to compare the alternative rehabilitation and replacement options. The present value analysis technique is used to calculate the cost of the alternatives in today’s dollars for work that will be carried out in the future. A summary of the present value of the alternatives for replacement at 10 years for different discount rates is presented in the following table, and shows that maintaining the existing bridge is more expensive in most sensitivity analysis scenarios.

| Alternative | Life cycle cost for 0 to 75 years (without discount) |

Discount rate | ||

|---|---|---|---|---|

| 2.0% | 3.5% | 5.0% | ||

| Maintain existing | 650,400,000 | 444,100,000 | 251,300,000 | 186,600,000 |

| Replacement in kind | 415,400,000 | 310,100,000 | 215,900,000 | 173,700,000 |

| Contemporary replacement | 301,300,000 | 231,200,000 | 164,500,000 | 134,600,000 |

| Signature replacement | 450,700,000 | 361,000,000 | 262,000,000 | 216,000,000 |

A sensitivity analysis was carried out to determine the effects of a changing discount rate on the present value of the alternatives and demonstrated that the life cycle cost of maintaining the existing bridge is more sensitive to discount rate changes. The increased sensitivity of the “Maintain” option is explained by the distribution of the main capital cost investments over a long period of time. The major capital investments of the replacement options are concentrated within the first 10 years where the discount rate has a less important effect on present value costs.

A risk allocation has been assigned for the life cycle cost of each option evaluated. The risk contingency for the capital costs applied to each option is presented in the following table using a 3.5% discount rate.

| Maintain | In kind | Contemporary | Signature | |

|---|---|---|---|---|

| Life cycle cost | 251,300,000 | 215,900,000 | 164,500,000 | 262,000,000 |

| Risk allocation | 101,800,000 | 59,600,000 | 32,500,000 | 94,700,000 |

| Total cost | 353,200,000 | 275,500,000 | 197,100,000 | 356,600,000 |

Life cycle cost versus delay to replacement

An analysis of the time-sensitive financial impacts was performed to evaluate the life cycle costs based on a replacement schedule of 10, 15, 25, 50 and 75 years and are presented in the figure. While a replacement schedule of less than 10 years would yield a greater return, the thorough and complicated process associated with the replacement of an asset of such significance as the Alexandra Bridge is likely to result in a lengthy evaluation, selection and design period. As such, PSPC should consider a minimum remaining service life of 10 years for any of the potential replacement scenarios.

Table: Life cycle cost versus delay to replacement (in millions of dollars)

| Year to replacement | Maintain | In kind | Contemporary | Signature |

|---|---|---|---|---|

| 10 | 251,312,824 | 215,922,154 | 164,577,649 | 262,014,403 |

| 15 | 251,312,824 | 248,617,460 | 202,055,301 | 284,097,828 |

| 25 | 251,312,824 | 292,978,595 | 259,969,268 | 318,131,296 |

| 50 | 251,312,824 | 253,548,984 | 239,580,821 | 264,192,295 |

| 75 | 251,312,824 | 251,750,968 | 245,841,197 | 256,254,644 |

If a decision were to be made to replace the Alexandra Bridge with a new structure, whether in kind, contemporary or signature, it is the opportune time to replace the structure within the next 10 years. This takes into account the significant capital costs that will be required to maintain the existing structure, especially past the 10-year mark.

As part of the next steps to be undertaken by PSPC, it is recommended to first determine the most appropriate approach to maintaining the crossing. Many other factors, including socioeconomic, transportation planning, cultural and heritage significance, life cycle assessment and environmental impacts should be considered in addition to the findings of this study so a complete decision can be formulated. This is to ensure the best value to the Crown and to Canadians when assessing whether to rehabilitate or replace the existing structure with a contemporary or signature bridge.

- Date modified: